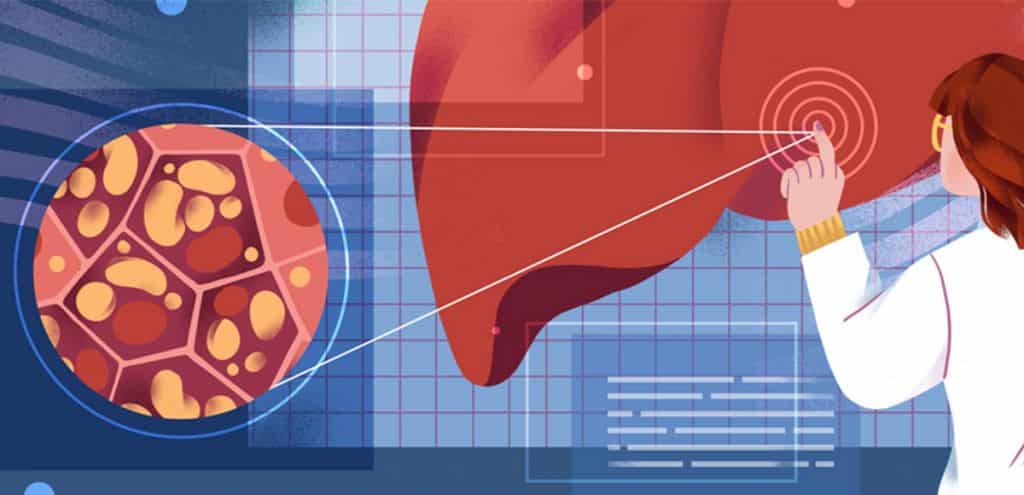

Despite several high-profile trial failures in the field, multiple players are getting close to the approval stage with drug candidates for NASH, a ‘silent killer’ that affects the liver.

Non-alcoholic steatohepatitis (NASH) is one of the most common reasons for liver transplantation. This condition consists of an abnormal buildup of fat in the liver that can lead to cirrhosis, liver failure, or cancer.

There is a NASH treatment approved in India since 2020, but none in Europe or the US. Many companies are working feverishly to be the first to get a treatment on these markets, but none have yet been successful.

In recent years, there have been a number of high-profile disappointments in the NASH field. In 2020, one of the most advanced drug candidates in the global pipeline, Genfit’s elafibranor, failed to prevent the worsening of tissue scarring, or fibrosis, in a phase III trial that recruited over 700 NASH patients. In the previous two years, Gilead’s drug selonsertib and Conatus Pharmaceuticals’ candidate emricasan had also failed in phase III studies.

Later in 2020, the FDA denied approval to Intercept Pharmaceuticals’ drug candidate Ocaliva (obeticholic acid). And during 2021, Pfizer and NGM Bio dropped their respective phase II-stage NASH candidates.

“We’re in the early days and I wouldn’t generalize,” said Manuel Baader, Global Head of Boehringer Ingelheim’s cardiometabolic diseases department. “All these programs have different reasons why they failed. I think it’s very important to try to find out what we can do differently, what we can do better.”

A multitude of targets

NASH is a complex disease, both to diagnose and to treat. Drug developers have taken a variety of different approaches to tackling this condition, including targeting metabolic imbalances, inflammation, and fibrosis.

Among the drug candidates currently being evaluated in phase III trials is lanifibranor, which is being developed by French company Inventiva Pharma. The drug targets a group of molecules known as PPARs, which are involved in multiple aspects of NASH including metabolism, inflammation and fibrosis.

Inventiva’s candidate is the only one in the global clinical pipeline that targets all forms of PPAR molecules. According to the company, this key feature might make its drug work where other drugs targeting PPARs, such as Genfit’s elafibranor, have failed.

US-based company Madrigal Pharmaceuticals is currently running a phase III trial in 2,000 patients with NASH. Its drug candidate, resmetiron, aims to increase the metabolism of fat in the liver by targeting thyroid hormone receptors. Novo Nordisk’s diabetes drug semaglutide (Ozempic) is also a phase III-stage contender for becoming the first NASH treatment.

Despite an FDA rejection in 2020 followed by the withdrawal of its EMA application, Intercept Pharma is still seeking approval for its drug Ocaliva, which is already on the market for another liver condition known as primary biliary cholangitis (PBC). The company is currently gathering and analyzing additional data in order to resubmit its marketing applications to both the FDA and EMA.

New frontiers in NASH research

Another possible treatment area in the NASH field is cell therapy. This approach could tackle the disease by providing new, healthy liver cells – also known as hepatocytes – in order to replace the cells that have been damaged by the accumulation of fat.

One of the most advanced within this field is the Belgian company Cellaïon, which is developing liver stem cell therapies to treat liver diseases. The company’s lead candidate, which was acquired from Promethera Biosciences, is being tested in phase II trials in patients with acute-on-chronic liver failure (ACLF) as well as NASH.

French biotech Goliver Therapeutics is also developing cell therapies that consist of injecting a solution containing liver cells produced from human stem cells. The approach is currently being tested in preclinical trials.

“If you decrease inflammation and you decrease fibrosis, but you don’t have a cell source for hepatocytes, how can you cure the disease? You can just slow down the disease,” said Tuan Huy Nguyen, CEO at French biotech Goliver Therapeutics.

While these regenerative approaches are at an earlier development stage, they are increasingly attracting the attention of big pharma.“We are also considering alternatives such as cell therapies,” said Baader. “I think NASH is a nice field to explore beyond small molecules, peptides, and antibodies.”

Baader believes better preclinical models will also be important for improving outcomes in NASH research. Currently, finding an animal model that accurately represents how the disease develops in humans is challenging. He advocates the use of additional preclinical testing systems such as human cell lines, complex 3D culture systems, organoids, or precision-cut liver slices to test a prospective drug’s mode of action thoroughly.

In addition, taking a personalized medicine approach and stratifying treatments to certain patient groups could be the answer to achieving better clinical results in NASH patients.

After its phase III failure, Genfit has moved into developing diagnostics for NASH. Currently, the disease is diagnosed through a liver biopsy. Non-invasive diagnostics will make it easier to diagnose patients earlier and treat them when the liver damage is still limited. This could in turn help trial design and patient selection during clinical studies.

“I think there is still room to learn how we can design the best clinical trial for our molecules,” said Baader. “One other thing is that it’s a very complex disease. We don’t really understand it. We have a lot of underlying mechanisms and there will not be one mechanism to solve the problem.”

Boom or bust?

“NASH is still a young space. The drug development has been ongoing for around seven years. There were trials, of course, 15 years ago, but that was the early stuff. Now, there’s a boom in development,” said Marco Boorsma, General Partner at Forbion, a VC firm with experience investing in NASH.

Boorsma believes that the NASH field just needs a bit more time. “It’s not like Alzheimer’s, where time after time, everything has failed. Here, it seems that you can get to some kind of improvement that will hopefully develop into something great. As investors, we really see it as an opportunity.”

The NASH trial failures could actually be seen as opportunities for companies developing similar candidates at an earlier stage to learn and adapt. However, negative press can make investment in the area difficult.

“With every trial, with every motivation test, we learn,” said Boorsma. “I think in the next 10 or 15 years, there will be maybe 10 or 15 different drugs with different modes of action on the market.”

This article was originally published on 16/04/2019 and has since been updated to reflect recent developments in the NASH field.rnrnTable created by Jon Smith, quotes provided by Helen Albert. The cover illustration was created by Elena Resko and the images obtained via Shutterstock.